basilh@virginia.edu

@basilhalperin

(Ex post update: After this post was published, the FOMC met for an emergency meeting, in which it cut the policy interest rate to zero and began a new round of quantitative easing, among other measures!)

If I closed my eyes and completely wiped from my mind the fact of the coronavirus pandemic, here's what I would see in the last week:

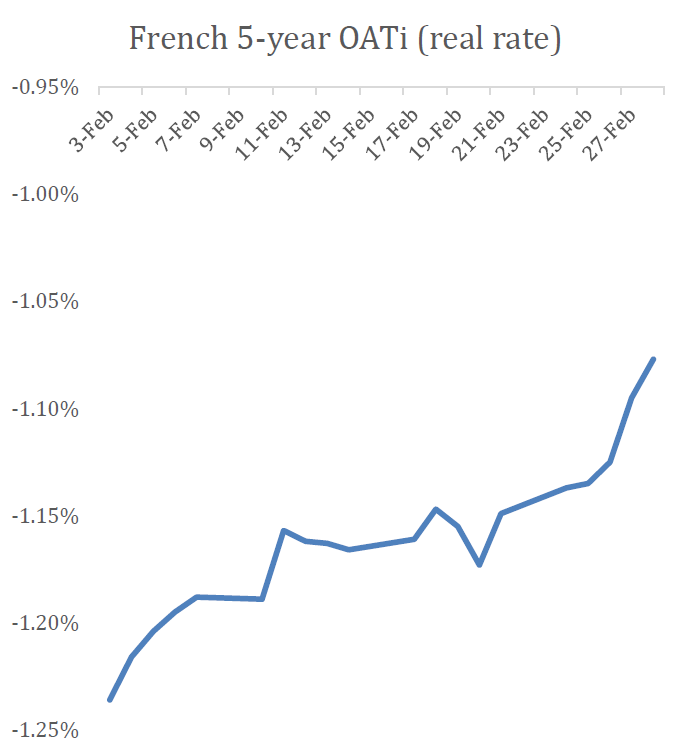

1. Real interest rates are rising: 5 year TIPS rates are up 80bps (!!) in the last 1.5 weeks

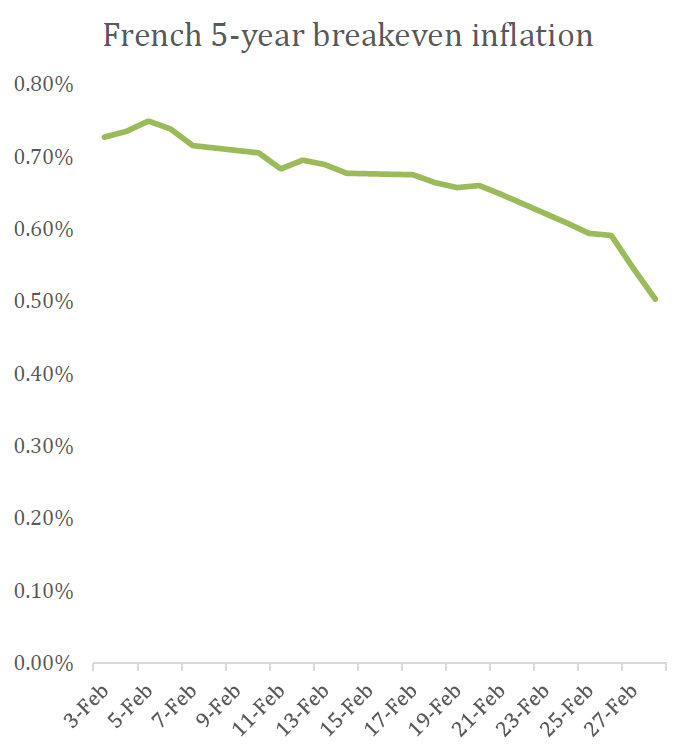

2. Inflation expectations are collapsing: 5-year breakeven inflation is down to 0.50%

3. In the last week, even nominal interest rates are rising: 2-year treasuries rose in the past few days, including even on Thursday when equity markets were down 10%

4. Equity prices, of course, cratering

The data are not 100% clear, but this looks like a massive contractionary monetary policy shock. Interpreting these data:

1. Real rates are rising: this could be due to

(1) rising growth expectations (...unlikely);

(2) risk premia movements (maybe? Would have to be large);

(3) higher TIPS illiquidity premium (probable – cf Fed action on Thursday); or

(4) changing subjective discount factor (seems unlikely for a five-year horizon?)

(5) tighter monetary policy expectations (seems very possible!)

This reads to me like monetary policy is tightening. Even if much of the movement is due to liquidity issues rather than a change in the expected path of real rates, that illiquidity would also suggest monetary policy is too tight!

2. Inflation expectations are falling: this could be in part due to the positive oil supply shock; but expectations were falling before Saudi Arabia and Russia made their moves on March 9. Moreover, we would ceterus paribus think that the negative supply-side effects of the coronavirus would increase inflation.

3. Nominal rates: It is truly bizarre, in my mind, to see nominal Treasury yields rising in the past few days – and not just on days when the stock market was up, like Friday. That seems suggestive of expectations for tighter-than-previously-expected monetary policy.

It's also possible that liquidity issues in both the nominal and real government bond markets are distorting all of these measures. I don't know, these are some of the most liquid markets in the world.

The data above are for the US, but looking at French government bonds, I also see real rates rising (!!) and inflation expectations falling:

Meanwhile, the ECB on Thursday chose not to cut interest rates, despite widespread expectation for them to cut, which seems frankly insane (and equity markets were subsequently down 10-15%!).

Watching these various indicators – particularly real interest rates rising almost a full percentage point (!) – frankly I feel a little like I'm going crazy. Everyone is talking about the pandemic – rightly – but it seems to me that we have a dual crisis at the moment. The virus, and monetary policy is way too tight.

In the US, we are not at the zero lower bound, so the Fed has no excuse for not acting. And before the FOMC uses the ZLB as an excuse anyway, they could at least attempt forward guidance or actual QE (not the repo liquidity measures that occurred on Thursday).

Obviously, the pandemic is a big crisis with its own set of complicating issues. But central banks shouldn't be making the problem worse than it need be. I.e., even if potential real GDP falls due to the pandemic and associated shutdowns, central banks should still be (approximately) trying to keep GDP on track with potential GDP (modulo perhaps some tradeoff with price dispersion), not implicitly tightening policy and making things even worse.

The supply side, as almost always, is more important; but at the moment central banks seem like they're actively or passively making things worse.

It will be very informative, I think, to watch the market open tonight.