basilh@virginia.edu

@basilhalperin

I have created a new set of questions on the forecasting platform Metaculus to help predict what monetary policy will look like over the next three decades. These questions accompany a “fortified essay” located here which offers context on the importance of these questions, which I expand on below.

You, yes you, can go forecast on these questions right now – or even go submit your own questions if you’re dissatisfied with mine.

My hope is that these forecasts will be, at the least, marginally useful for those thinking about how to design policy – but also useful to researchers (e.g.: me!) in determining which research will be most relevant in coming decades.

Below I give some background on Metaculus for those not already familiar, and I offer some thoughts on my choice of questions and their design.

I. Brief background on Metaculus

The background on Metaculus is that the website allows anyone to register an account and forecast on a huge variety of questions: from will Trump win the 2024 election (27%) to Chinese annexation of Taiwan by 2050 (55%) to nanotech FDA approval by 2031 (62%). Interestingly, the questions need not be binary yes/no and instead can be date-based – e.g. year AGI developed (2045); or nonbinary – e.g. number of nuclear weapons used offensively by 2050 (1.10).

Metaculus is not a prediction market: you do not need to bet real money to participate, and conversely there is no monetary incentive for accuracy.

This is an important shortcoming! THE reason markets are good at aggregating dispersed information and varying beliefs is the possibility of arbitrage. Arbitrage is not possible here.

II. Metaculus is surprisingly accurate

Nonetheless, Metaculus has both a surprisingly active userbase and, as far as I can tell, a surprisingly good track record? Their track record page has some summary statistics.

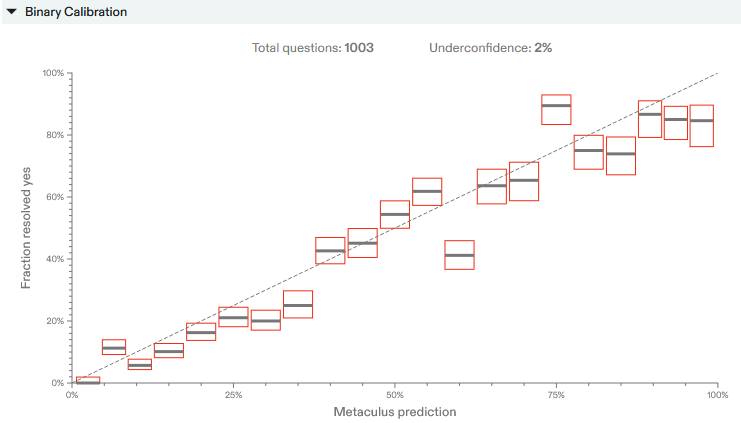

For binary yes/no questions, taking the Metaculus forecast at 25% of the way through the question lifetime, the calibration chart looks like this:

The way to read this chart is that, for questions where Metaculus predicts a (for example) 70% probability of a “YES” outcome, it happens 67.5% of the time on average.

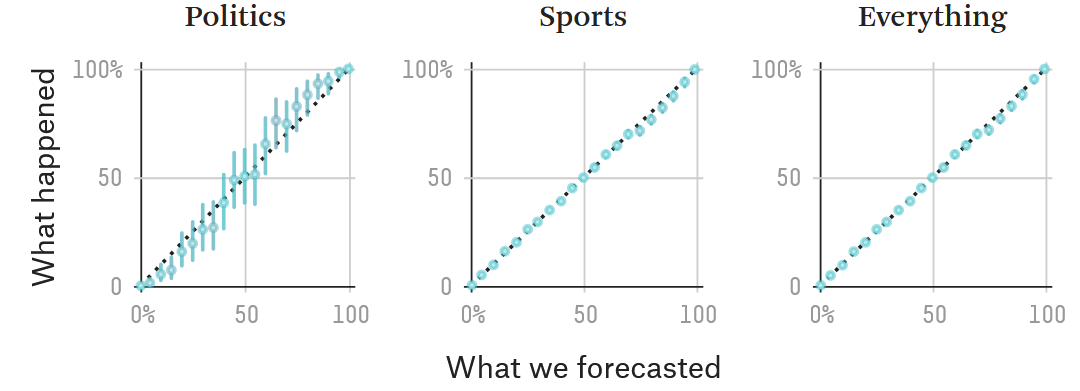

For comparison, here is FiveThirtyEight’s calibration chart:

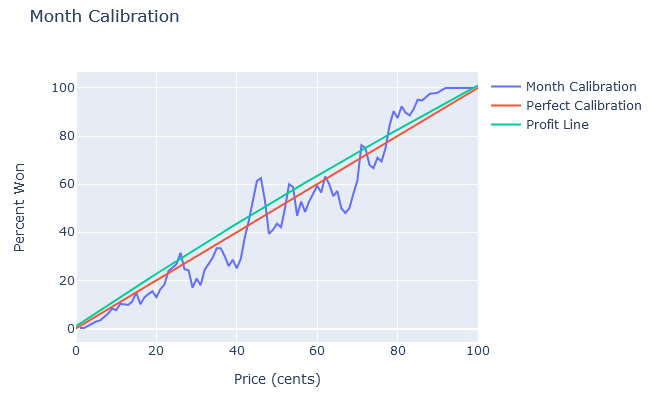

And here is an actual prediction market, PredictIt, using 9 months’ worth of data collected by Jake Koenig on 567 markets:

(See also: Arpit Gupta’s great analysis of prediction markets vs. FiveThirtyEight on 2020 US elections. If you want to be a real nerd about this stuff, Scott Alexander’s “Mantic Monday” posts and Nuño Sempere’s Forecasting Newsletter have good regular discussions of new developments in the space.)

A potentially very important caveat is that these calibration charts only score the accuracy of yes-versus-no types of questions. For date-based questions (e.g. “AGI when?”) or questions with continuous outcomes, scoring accuracy is more complicated. I don’t know of a great way to score, let alone visualize, the accuracy of date-based questions; send suggestions. Metaculus’ track record page offers the log score, which is one particular accuracy statistic, for all questions:

As far as I’m aware, the only way to interpret this is: ‘higher is gooder’. I also do not have any reference forecasters to which this can be compared, unlike for the binary questions above – again, making things hard to interpret. The log score also does not capture all of the information contained in the entirety of the CDF of a forecast; only the forecasted probability at the resolution date.

Last, given that Metaculus launched in 2017, it’s not yet possible to analyze the accuracy of long-run forecasts.

III. Metaculus for forecasting monetary policy design

For macroeconomics, we already have some forecasts directly from financial markets for short- or medium-term variables, e.g. predictions for the Fed’s policy interest rate.

I think forecasts for longer-term questions and for questions not available on financial markets could be useful for researchers and practitioners. To make this argument, I’ll walk through the questions I wrote up for Metaculus, listed in the intro above.

The first set of questions is about the zero lower bound and negative interest rates: when is the next time the US will get stuck at the ZLB; how many times between now and 2050 will we end up stuck there; and will the Fed push interest rates below zero if so.

This is of extreme practical importance. The ZLB is conventionally believed to be an important constraint on monetary policy and consequently a justification for fiscal intervention (“stimmies”). If we will hit the ZLB frequently in coming decades, then it is even more important than previously considered to (1) develop our understanding of optimal policy at the ZLB, and (2) analyze more out-of-the-Overton-window policy choices, like using negative rates.

A policy even further out of the Overton window would be the abolition of cash, which is another topic I solicit forecasts on for the US as well as for China (where likely this will occur sooner). If cash is abolished, then the ZLB ceases to be a constraint. (This to me implies pretty strongly that we ought to have abolished cash, yesterday.)

Cash abolition would be useful to predict not just so that I can think about how much time to spend analyzing such a policy; but also because abolishing cash would mean that studying “optimal policy constrained by the ZLB” would be less important – there would be no ZLB to worry about!

Finally, I asked about if the Fed will switch from its current practice of focusing on stabilizing inflation (“inflation targeting”/“flexible average inflation targeting”) to nominal GDP or nominal wage targeting. This is a topic especially close to my own research.

IV. Questions I did not ask

There are a lot of other questions, or variations on the above questions, that I could have asked but did not.

Expanding my questions to other countries and regions is one obvious possibility. As just one example, it would also be useful to have a forecast for when cash in the eurozone might be abolished. The US-centrism of my questions pains me, but I didn’t want to spam the Metaculus platform with small variations on questions. You should go create these questions though 😊.

Another possible set of questions would have had conditional forecasts. “Will the US ever implement negative rates”; “conditional on the US ever implementing negative rates, when will it first do so”. This would be useful because the questions I created have to smush together these two questions. For example: if Metaculus forecasts 2049 for the expected date of cash abolition, does that mean forecasters have a high probability on cash being abolished, but not until the late 2040s; or that they expect it may be abolished in the next decade, but otherwise will never be abolished? It’s hard to disentangle when there’s only one question, although forecasters do provide their full CDFs.

A final set of possible questions that I considered were too subjective for the Metaculus platform: for example, “Will the ECB ever adopt a form of level targeting?” The resolution criteria for this question were just too hard to specify precisely. (As an example of the difficulty: does the Fed’s new policy of “flexible average inflation targeting” count as level targeting?) Perhaps I will post these more subjective questions on Manifold Markets, a new Metaculus competitor which allows for more subjectivity (which, of course, comes at some cost).

Thanks to Christian Williams and Alyssa Stevens from the team at Metaculus for support, and to Eric Neyman for useful discussion on scoring forecasts.